https://finanzasdomesticas.com/fondos-mutuos-de-inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion are a great way to invest money. They let people put their money together to buy lots of different things, like stocks and bonds. This helps to spread out the risk and makes investing safer and easier.

Many people like fondos-mutuos-de-inversion because they are managed by experts. These experts make sure the money is invested wisely. This means you don’t have to worry about choosing the best stocks or bonds yourself.

What Are Fondos-Mutuos-De-Inversion?

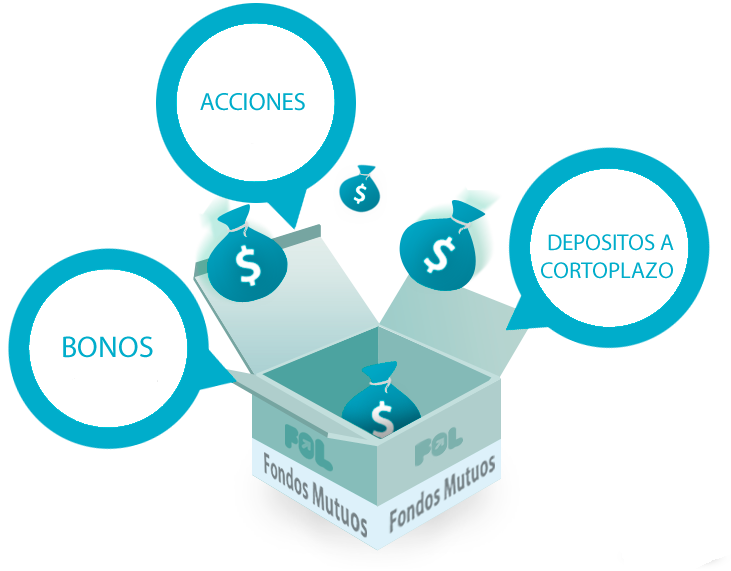

Fondos-mutuos-de-inversion are like big money pools. Lots of people put their money together. This money is used to buy things like stocks and bonds. It’s a way for people to invest without doing it alone.

https://finanzasdomesticas.com/fondos-mutuos-de-inversion When people invest together, they share the risk. This means if one stock goes down, it won’t hurt as much. The experts who manage the funds know what to buy. They make smart choices to help the money grow.

These funds are good for people who don’t know much about investing. You don’t need to pick stocks or bonds yourself. Just put your money in the fund and let the experts do the work. It’s an easy way to start investing.

How Do Fondos-Mutuos-De-Inversion Work?

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion work by pooling money. Everyone puts in their money together. This big pool is then used to buy a variety of investments. This can include stocks, bonds, and other assets.

When the investments make money, everyone in the fund benefits. If the investments lose money, everyone shares the loss. The goal is to have more gains than losses over time. The experts managing the fund try to make smart choices.

Investors can buy shares in the fund. Each share represents a piece of the total pool. The value of your shares goes up or down with the value of the investments. It’s a simple way to invest without having to pick each stock or bond yourself.

Benefits of Investing in Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion There are many benefits to investing in fondos-mutuos-de-inversion. One big benefit is diversification. This means your money is spread across many investments. This can reduce risk and make your investment safer.

Another benefit is professional management. Experts handle the investments. They have the knowledge and experience to make good decisions. This can be very helpful if you don’t know much about investing.

Fondos-mutuos-de-inversion are also easy to use. You don’t need to pick and choose investments. You just invest in the fund and let the experts do the rest. It’s a convenient way to grow your money.

Different Types of Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion There are many types of fondos-mutuos-de-inversion. Some focus on stocks. These are called equity funds. They invest in companies’ shares. These can be a good way to grow your money over time.

Other funds focus on bonds. These are called bond funds. Bonds are like loans to companies or governments. They usually pay regular interest. Bond funds can be a safer investment compared to stocks.

There are also balanced funds. These invest in both stocks and bonds. They try to balance growth and safety. This can be a good option if you want a mix of both types of investments.

How to Start Investing in Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Starting to invest in fondos-mutuos-de-inversion is easy. First, choose a fund that fits your goals. Look for one with a good track record. Check the fees and costs. Lower fees can mean more money for you.

Next, open an account with a brokerage. Many banks and investment companies offer these accounts. You can do this online or in person. Once your account is set up, you can buy shares in the fund.

Finally, decide how much to invest. You can start with a small amount and add more later. Many funds let you invest a little bit each month. This can help you grow your investment over time.

Expert Tips for Choosing Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Choosing the right fondos-mutuos-de-inversion can be tricky. Experts say to look at the fund’s history. A good track record can show you how well the fund has done. Check the fees, too. Lower fees mean more money stays with you.

It’s also good to know what the fund invests in. Some funds focus on specific sectors, like technology. Others invest in many different industries. Choose one that matches your goals and risk level.

Diversify your investments. Don’t put all your money in one fund. Spread it across different funds. This can reduce risk and help you earn more. Listen to expert advice but make sure the choices fit your own needs.

Risks of Fondos-Mutuos-De-Inversion and How to Avoid Them

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Investing in fondos-mutuos-de-inversion has risks. One risk is that the investments can lose value. If the stock market goes down, your fund might lose money. This is a risk with all investments.

Another risk is fees. Some funds charge high fees. These can eat into your profits. Always check the fee structure before you invest. Look for funds with lower fees.

To avoid risks, diversify your investments. Don’t put all your money in one fund. Spread it out across different types. This can help protect your money if one investment does poorly. Always keep an eye on your investments and make changes if needed.

Fondos-Mutuos-De-Inversion vs. Individual Stocks: Which Is Better?

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion and individual stocks have differences. With individual stocks, you buy shares in one company. This can be risky if that company does poorly. But it can also bring big rewards if the company does well.

Fondos-mutuos-de-inversion spread the risk. Your money is invested in many different stocks or bonds. This can be safer but might bring smaller returns compared to individual stocks.

Deciding which is better depends on your goals. If you like picking stocks and can handle risk, individual stocks might be for you. If you want safety and expert management, fondos-mutuos-de-inversion are a good choice.

How Fondos-Mutuos-De-Inversion Can Help You Save for the Future

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion are great for saving. They help your money grow over time. By investing regularly, you can build a good amount for the future. This is important for things like retirement or buying a house.

Many people use these funds to save for big goals. Putting money in each month can add up. Over time, your investment grows with the market. This can help you reach your financial goals faster.

Starting early is key. The sooner you start investing, the more time your money has to grow. Fondos-mutuos-de-inversion can make saving easy and effective. It’s a smart way to prepare for the future.

Understanding the Fees in Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fees are important in fondos-mutuos-de-inversion. They can affect your returns. There are different types of fees to know about. One is the management fee. This is what you pay the experts who manage the fund.

Another fee is the expense ratio. This covers the fund’s costs. It’s usually a small percentage of your investment. Some funds also have a load fee. This is a fee you pay when you buy or sell shares.

Always check the fees before you invest. Lower fees mean more of your money stays with you. Comparing fees between funds can help you make a smart choice. Keeping fees low can boost your overall returns.

Success Stories: People Who Benefited from Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Many people have benefited from fondos-mutuos-de-inversion. One story is of a teacher who started investing small amounts. Over time, her investment grew. She was able to retire comfortably because of her smart choices.

Another success story is a young couple saving for a house. They put money into a fund each month. After a few years, they had enough for a down payment. Their regular investments made their dream come true.

There are many stories like these. Fondos-mutuos-de-inversion can help people reach their goals. Regular investing and smart choices can lead to great results. It’s a proven way to build wealth over time.

The Future of Fondos-Mutuos-De-Inversion: What to Expect

https://finanzasdomesticas.com/fondos-mutuos-de-inversion The future of fondos-mutuos-de-inversion looks bright. More people are using these funds to save and invest. Technology is making it easier to manage investments. Online tools and apps help people keep track of their funds.

Experts believe these funds will continue to grow. New types of funds are being created. These can offer more choices and flexibility. Sustainable and ethical funds are becoming popular. They invest in companies that do good for the world.

Investing in fondos-mutuos-de-inversion will likely become even easier. As more people learn about them, they will become a common choice for saving and investing. The future is promising for these smart investment options.

How Fondos-Mutuos-De-Inversion Help Beginners

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion are perfect for beginners. They are easy to understand and use. New investors don’t need to know a lot about the stock market. The funds are managed by experts who make smart choices for you.

Beginners can start with a small amount of money. Many funds let you invest with just a little. Over time, you can add more money. This helps your investment grow without a big upfront cost.

Investing in fondos-mutuos-de-inversion is also less risky. Because your money is spread across many investments, you don’t lose everything if one stock goes down. This makes it safer for new investors.

Choosing the Right Fondos-Mutuos-De-Inversion for You

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Choosing the right fondos-mutuos-de-inversion is important. First, think about your goals. Do you want to save for a house, a car, or retirement? Your goal will help you pick the right fund.

Look at the fund’s performance. Check how it has done over the years. A good track record can be a sign of a good fund. Also, check the fees. Lower fees mean more money stays with you.

Diversify your choices. Don’t put all your money in one fund. Pick a few different ones to spread the risk. This can help you grow your investment safely and steadily.

Understanding the Returns on Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Returns are what you earn from your investment. Fondos-mutuos-de-inversion can give good returns over time. The value of your shares goes up as the investments grow. You can also earn dividends. These are payments made from the fund’s profits.

Returns can vary. Some years you might earn a lot, and other years less. The goal is to have more good years than bad ones. This way, your money grows over time.

Reinvesting your returns can help your investment grow even more. Instead of taking the money out, put it back into the fund. This way, your returns start earning returns too.

The Role of Fund Managers in Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fund managers are key to fondos-mutuos-de-inversion. They are experts who make investment decisions. They choose which stocks, bonds, and other assets to buy. Their goal is to make the fund grow.

These managers use their knowledge and experience. They study the market and look for good opportunities. This helps to reduce risk and increase returns. They work hard to manage the fund well.

Investors trust fund managers to make smart choices. A good manager can make a big difference in how well the fund performs. It’s important to choose funds with experienced and successful managers.

Long-Term Benefits of Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Investing in fondos-mutuos-de-inversion can bring long-term benefits. Over time, your money can grow significantly. Regular investments add up, and the returns compound. This means you earn money on your earnings.

These funds are great for retirement savings. Starting early gives your investment more time to grow. By the time you retire, you can have a nice nest egg. This can help you live comfortably in your later years.

Fondos-mutuos-de-inversion also provide peace of mind. Knowing that experts are managing your money can reduce stress. You can focus on other things while your investment grows. It’s a smart way to build wealth for the future.

Common Myths About Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion There are some myths about fondos-mutuos-de-inversion. One myth is that they are only for rich people. This is not true. Anyone can invest in these funds, even with a small amount of money.

Another myth is that they are too complicated. While investing can be complex, fondos-mutuos-de-inversion are designed to be simple. Experts handle the hard parts, so you don’t have to worry.

Some people think that these funds don’t give good returns. In reality, many fondos-mutuos-de-inversion perform well over time. They can be a great way to grow your money safely and steadily.

Tax Implications of Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Investing in fondos-mutuos-de-inversion can have tax implications. When you earn money from your investment, you might have to pay taxes. This includes dividends and capital gains. It’s important to know how these taxes work.

Capital gains tax is paid when you sell your shares for more than you paid. Dividends are usually taxed as income. The rate can vary depending on your income level and the country you live in.

There are ways to reduce your tax burden. Some people use tax-advantaged accounts like IRAs or 401(k)s. These accounts can offer tax benefits and help your investment grow. Always check with a tax advisor to understand your situation.

The Best Time to Invest in Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Timing can be important when investing in fondos-mutuos-de-inversion. The best time to invest is when you have money to spare. Starting early is always a good idea. The more time your money has to grow, the better.

Market conditions can also affect your investment. Some people try to buy when prices are low. However, it’s hard to predict the market. Investing regularly, no matter the market conditions, can be a good strategy.

Long-term investing is key. Don’t worry too much about short-term ups and downs. Over time, your investment can grow steadily. Stay patient and keep investing regularly.

Comparing Fondos-Mutuos-De-Inversion to Other Investments

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Fondos-mutuos-de-inversion are different from other investments. Compared to savings accounts, they can offer higher returns. Savings accounts are safe but usually have low interest rates. Fondos-mutuos-de-inversion can grow more over time.

Stocks can be more risky than fondos-mutuos-de-inversion. When you buy individual stocks, you depend on one company. If that company does poorly, you can lose money. Fondos-mutuos-de-inversion spread the risk by investing in many companies.

Real estate is another option. It can be profitable but requires a lot of money and effort. Fondos-mutuos-de-inversion are easier to manage. You can invest with less money and have experts handle the details.

How to Monitor Your Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Monitoring your fondos-mutuos-de-inversion is important. Regularly check the performance of your fund. Look at the returns and compare them to your goals. This helps you see if your investment is on track.

You can get updates from your fund manager. Many funds send out regular reports. These show how the investments are doing. They also provide information about fees and any changes in the fund.

Stay informed about the market. Knowing what’s happening can help you make better decisions. If needed, adjust your investment. This can help you stay aligned with your financial goals.

The Impact of Economic Changes on Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Economic changes can affect fondos-mutuos-de-inversion. When the economy is strong, investments tend to do well. Stocks go up, and your fund’s value increases. This is a good time for investors.

During a recession, things can be different. Stocks might go down, and your fund can lose value. It’s important to stay calm during these times. Long-term investors often recover when the market improves.

Diversification can help protect your investment. By having a mix of stocks and bonds, you can reduce the impact of economic changes. Keeping a balanced portfolio is key to weathering economic ups and downs.

How to Withdraw from Fondos-Mutuos-De-Inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Withdrawing money from fondos-mutuos-de-inversion is easy. First, decide how much you need. Then, contact your fund manager or use your online account. You can sell your shares and get the money.

There might be fees for withdrawing early. Some funds charge fees if you take out money too soon. Check the rules for your fund. It’s usually best to plan your withdrawals carefully.

Consider the tax implications. Withdrawing money might mean you have to pay taxes. It’s important to know how much you’ll owe. Planning ahead can help you avoid surprises.

Conclusion:https://finanzasdomesticas.com/fondos-mutuos-de-inversion

https://finanzasdomesticas.com/fondos-mutuos-de-inversion Investing in fondos-mutuos-de-inversion can be a great way to grow your money. They are easy to start with, even if you don’t know much about investing. Experts handle the hard work, so you can relax and watch your money grow over time.

Remember to pick the right fund for your goals. https://finanzasdomesticas.com/fondos-mutuos-de-inversion Keep an eye on your investment, but don’t worry about short-term changes. Stay patient and keep investing regularly. Fondos-mutuos-de-inversion can help you build a bright financial future.